accumulated earnings tax reasonable business needs

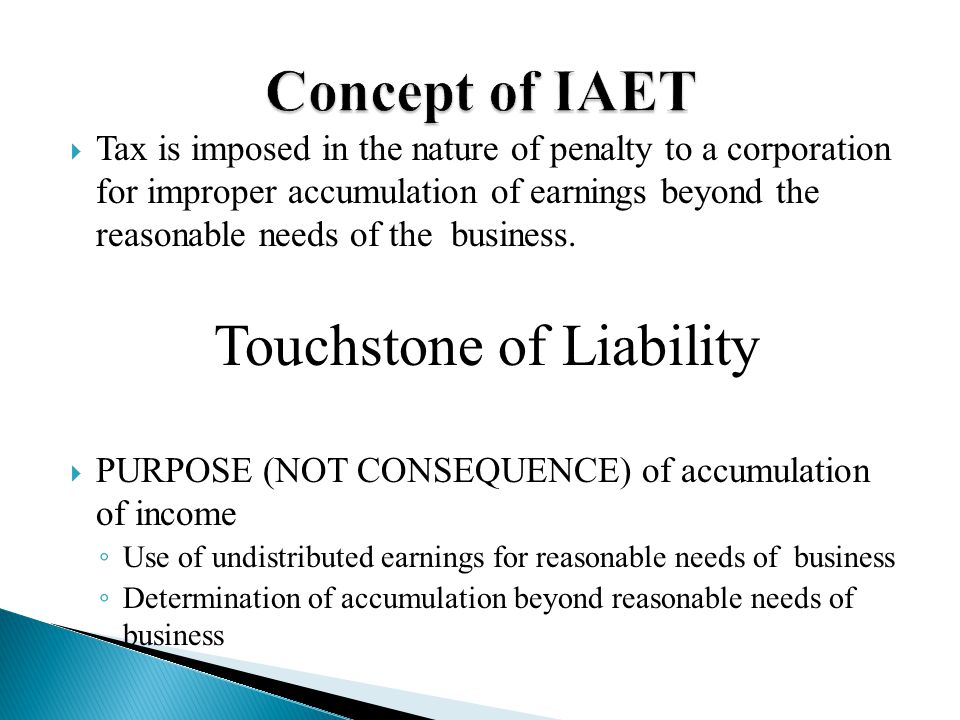

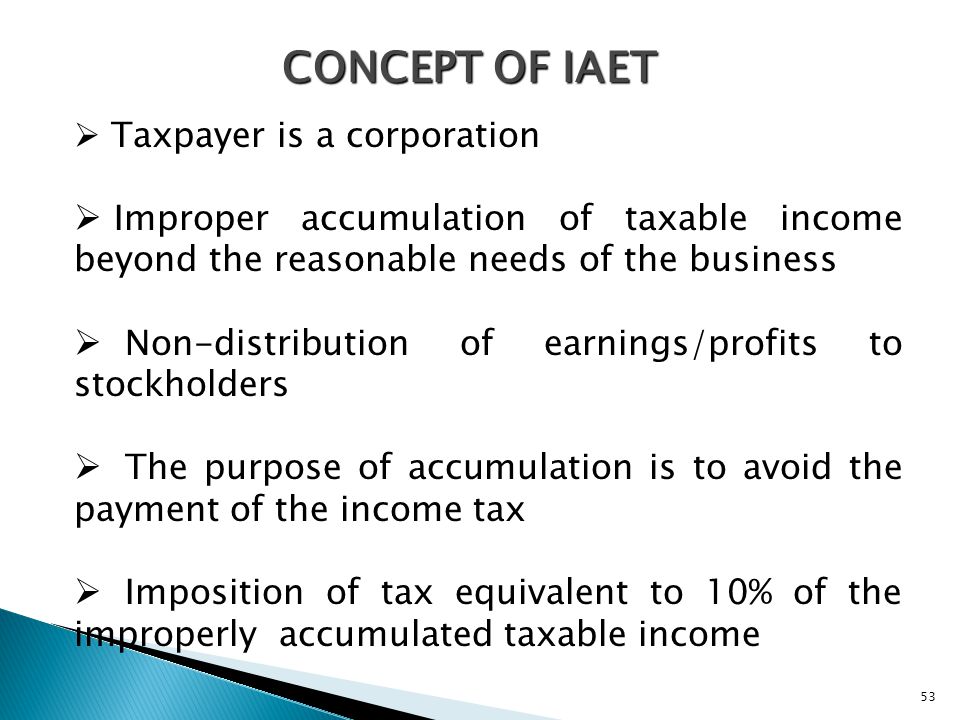

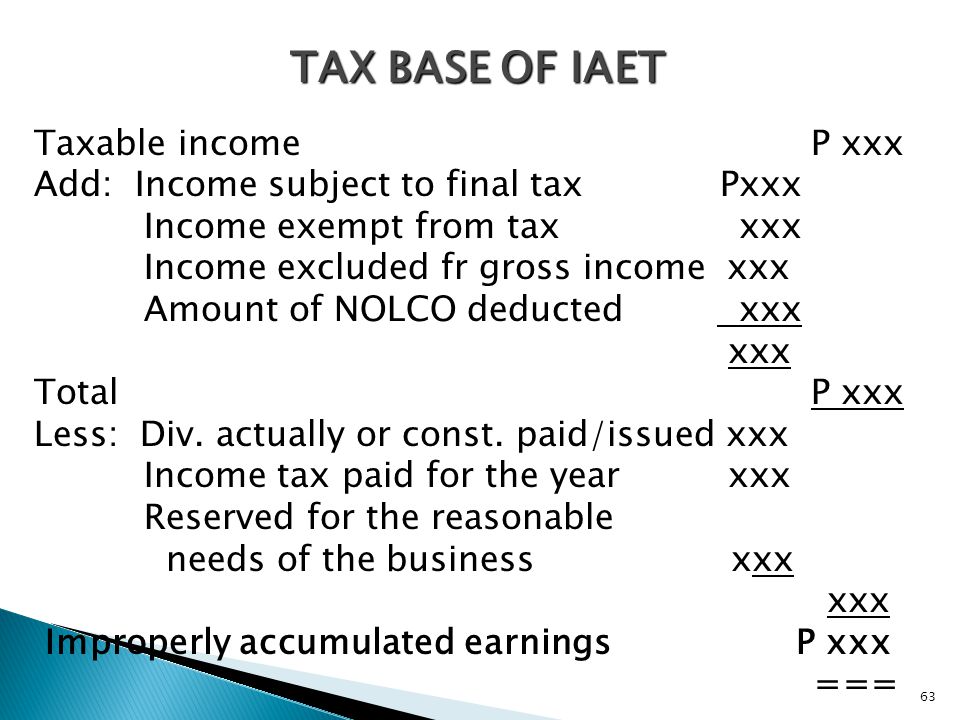

To be subject to the accumulated earnings tax the corporation generally must accumulate earnings beyond its reasonable business needs. The accumulation of reasonable amounts for the payment of reasonably anticipated product liability losses as defined in section 172f as in effect before the date of enactment of the.

To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends.

. Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Needs of the business.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. 1 27V2 percent of the accumulated taxable income not in excess of 100000 plus.

The working capital needs of a business in an accumulated earnings tax case is given a narrower definition and means the liquid assets needed for a regular business cycle. 2 redemptions in connection with sec-. For purposes of the accumulated earnings tax earnings can be accumulated for reasonable needs of the business.

2-2001 includes as among the items which. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. Relative to the accumulated earnings tax explain what reasonable business needs means and give 3 examples of what the IRS would likely accept as reasonable business needs.

And profits have been allowed to accumulate beyond the reasonable. Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. Within the reasonable needs of the business rubric.

Ad Corporate Tax Tools and Services to Help Businesses Accelerate Tax Transformation. Tion 303 relating to payment of a deceased. 2 381 percent of.

The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. The Tax Code defines reasonable needs to include the reasonably anticipated needs of the business.

An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that. A corporation is subject to the PHC tax if it. Strategies for Avoiding the Accumulated Earnings Tax.

List several examples of. The AET is a penalty tax imposed. Corporation described in section 532 an accumulated earnings tax equal to the.

Ad Corporate Tax Tools and Services to Help Businesses Accelerate Tax Transformation. 150000 200000 - 100000 250000. Anticipated needs of the business.

Track Your Business Expenses - Get QuickBooks Today For Your Expense Tracking Needs. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Achieve Your Goals By Using The Right Services Subject Expertise For Your Business.

Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today. Advanced Business Entity Taxation. In any proceeding before the Tax Court involving the allegation that a corporation has permitted its earnings and profits to accumulate beyond reasonable business needs the.

Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. When applicable the accumulated earnings tax is.

Improperly Accumulated Earnings Mpcamaso Associates

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Solved Pera Pera College An Educational Institution Provided The Following Data For The Current Year Income From Tuition Fees P3 000 000 School Course Hero

The Income Tax Rate Of Corporations Lowered In The Philippines Lawyers In The Philippines

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc Tax And Accounting Center Inc

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

Taxation Of Shareholder Loans Canadian Tax Lawyer Analysis

Income Tax Computation For Corporate Taxpayers Prepared By

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation For Corporate Taxpayers Prepared By

How To Prepare Corporation Income Tax Return For Business In Canada

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Strategies For Avoiding The Accumulated Earnings Tax Krd

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download