maine sales tax calculator

Wayfair Inc affect Maine. Food and prescription drugs are exempt in Maine while prepared food lodging and auto rentals.

Sales Taxes In The United States Wikiwand

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

. 2022 Maine Sales Tax Table. The Portland sales tax rate is. East Wilton is located within Franklin County MaineWithin East Wilton there is 1 zip code with the most populous zip code being 04234The sales tax rate does not vary based on zip code.

Thats why we came up with this handy Maine sales tax calculator. The rates that appear on tax bills in Maine are generally denominated in millage rates. If youve opened this page and reading this chances are you are living in Maine and you intend to know the sales tax rate right.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Well speaking of Maine there is a general sales tax of 55. A mill is the tax per thousand dollars in assessed value.

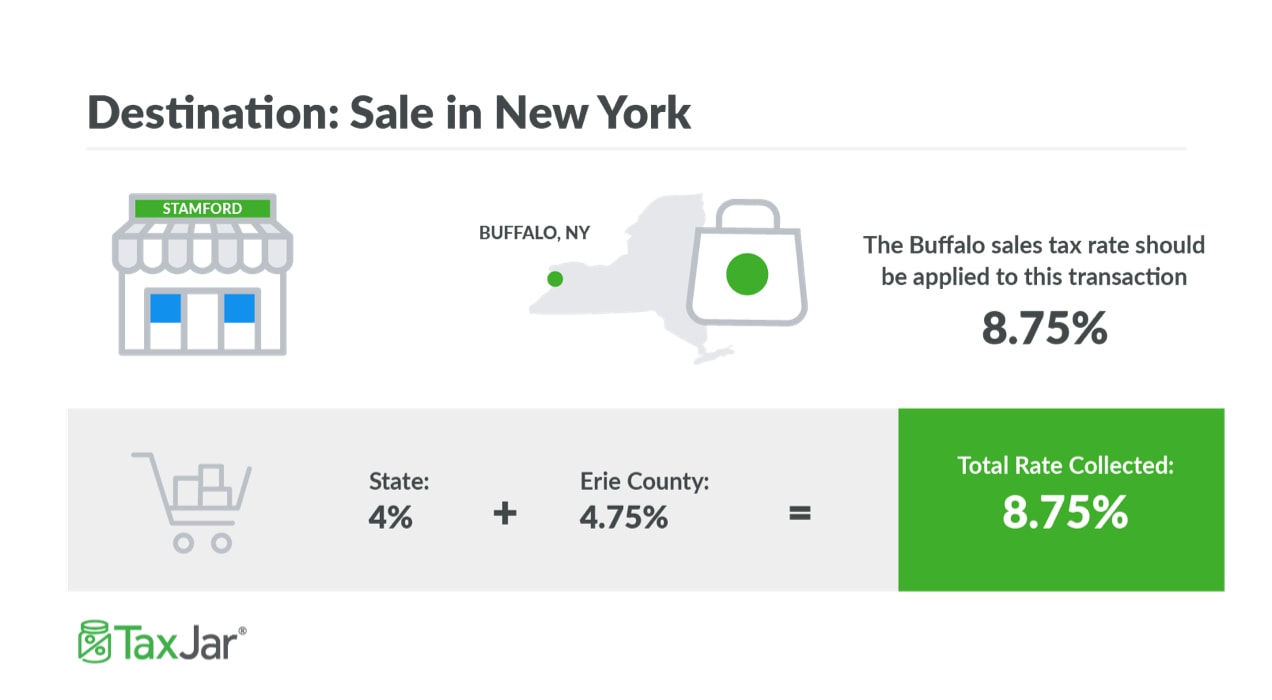

The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. This state sales tax also applies if you purchase the vehicle out of state. Then use this number in the multiplication process.

Find your Maine combined state and local tax rate. Maine sales tax details. The Maine Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Maine in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Maine.

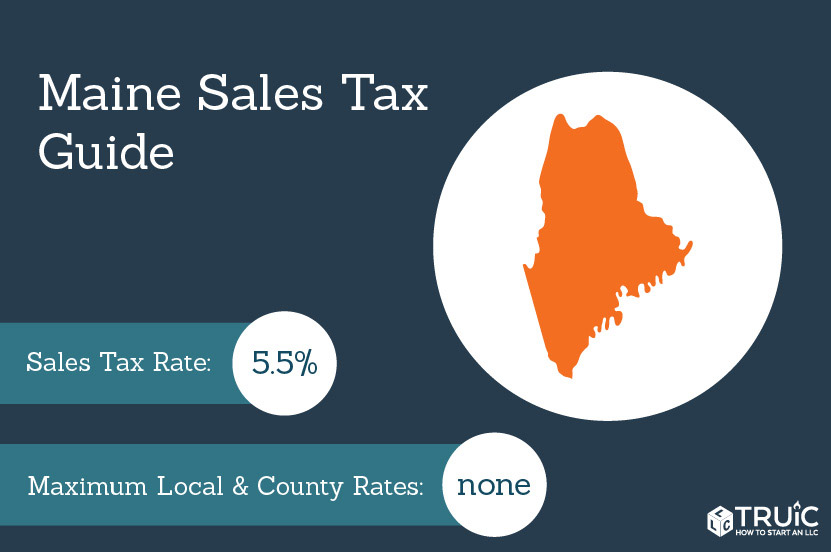

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The state sales tax rate is 55 and Maine doesnt have local sales tax rates. Retailers who want to request a payment plan may also contact the MRS Compliance Division at 207 624-9595 or compliancetaxmainegov.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Our income tax calculator calculates your federal state and local taxes based on several key inputs. - NO COMMA For new vehicles this will be the amount on the dealers sticker not the amount you paid.

The tax that is levied on lodging and prepared food is 8 and furthermore the short-term auto rental is 10. The car sales tax in Maine is 550 of the purchase price of the vehicle. Find list price and tax percentage.

Most transactions of goods or services between businesses are not subject to sales tax. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Maine local counties cities and special taxation. Exact tax amount may vary for different items.

Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes. This is the total of state county and city sales tax rates. For example if you purchase a new vehicle in Maine for 40000 then you will.

In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied. Maine sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The Maine sales tax rate is currently.

Maine Sales Tax Rates. So whether you live in Maine or outside Maine but have nexus and sell to a customer there you would charge your customer the 55 sales tax rate on most transactions. Sales tax is not collected at the local city county or ZIP in Maine making it one of the easier states in which to manage sales tax collection filing and remittance.

The average cumulative sales tax rate in Augusta Maine is 55. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Counties and cities are not allowed to collect local sales taxes.

Sales Tax Rate s c l sr. Maine levies taxes on tangible personal property which includes physical and digital products as well as some services. The sales tax rate does not vary based on zip code.

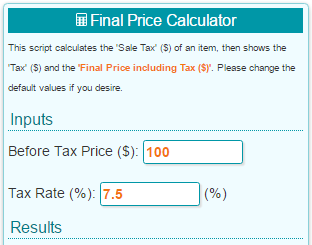

Divide tax percentage by 100 to get tax rate as a decimal. The County sales tax rate is. For more accurate rates use the sales tax calculator.

The minimum combined 2022 sales tax rate for Portland Maine is. Maine does not apply County Local or Special Sales Tax Rates tso the Total Sales Tax applied across the State of Maine is 55 you can calculate Sales Tax online using the. The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55.

The rates drop back on January 1st of each year. This includes the rates on the state county city and special levels. Maine Sales Tax Comparison Calculator for 202223.

Retailers can then file an amended return at a later date to reconcile the correct tax owed. Maine Property Tax Rates. For example the owner of a three year old motor vehicle with an MSRP of 19500 would pay 26325.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Your household income location filing status and number of personal exemptions. Within Augusta there are around 5 zip codes with the most populous zip code being 04330.

Groceries and prescription drugs are exempt from the Maine sales tax. The goods news is that Maine sets its Sales Tax Rate as a flat rate across the State so although the Sales Tax Formula Still applies. That said some items like prepared food are taxed differently.

How to Calculate Sales Tax. Enter your vehicle cost. Did South Dakota v.

Augusta is located within Kennebec County Maine. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. This includes the sales tax rates on the state county city and special levels.

Multiply the price of your item or service by the tax rate. You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122. This means that the applicable sales tax rate is the same no matter where you are in Maine.

Maine does not apply County Local or Special Sales Tax Rates tso the Total Sales Tax applied across the State of Maine is 55 you can calculate Sales Tax online using the Maine Sales Tax Calculator. 2022 Maine state sales tax. Our calculator has been specially developed in order to provide the users of the calculator with not only how.

The Maine ME state sales tax rate is currently 55. 54 rows Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Local tax rates in Maine range from 550 making the sales tax range in Maine 550.

For example a home with an assessed value of 150000 and a mill rate of 20 20 of tax per 1000 of assessed value would pay 3000 in annual property taxes. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or salestaxmainegov. The average cumulative sales tax rate in East Wilton Maine is 55.

Sales Tax On Grocery Items Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

Maine Vehicle Sales Tax Fees Calculator

Maine Vehicle Sales Tax Fees Calculator

Maine Sales Tax Information Sales Tax Rates And Deadlines

Item Price 90 Tax Rate 18 Sales Tax Calculator

Maine Vehicle Sales Tax Fees Calculator

Where S My Maine State Tax Refund Taxact Blog

How To Calculate Cannabis Taxes At Your Dispensary

New Jersey Sales Tax Calculator Reverse Sales Dremployee

Maine Sales Tax Small Business Guide Truic

Maine Vehicle Sales Tax Fees Calculator

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maine Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price